The bewildering world of Chris Luxon - The tax rort that keeps on giving...

...to the rich. (Trigger Warning: this will p*ss you right off.)

.

.

If ever there was a need for a Capital Gains Tax (CGT) in Aotearoa New Zealand, a recent event put the case in stark relief:

.

.

Thomas Manch, from The Post, reported:

Property records show Luxon bought the home in 2007 for $373,000, and Homes.co.nz estimated its current market value could be $1.07 million - which could mean a $697,000 capital gain, if that price was obtained.

There will be no mortgage to settle with the sale. According to public disclosures, Luxon has no mortgages on any of his seven properties.

Nor will there be any tax on the expected capital gain.

$700,000 - tax free.

Capital gains (with some notable exceptions) attract no tax whatsoever. This is despite the majority of New Zealanders believing that “income from shares and property investments should be taxed like income”.

Christopher Walsh, Founder of MoneyHub, an independepent investment website, points out what we already know;

“The general absence of a capital gains tax has led to a lot of political debate. For example, someone with a $1m investment property can sell it for $1.8m and make $800,000 untaxed, whereas someone earning the new minimum wage will pay up to 30% tax (if they work 48+ hours a week).

The lack of equality in the tax system is arguably a contributor to growing poverty levels throughout New Zealand. But for now, it's likely things will carry on as they always have done until a government addresses the issues in everyday New Zealand society. Whether that will ever happen remains anyone's guess.”

Mr Walsh has worked as an equity analyst at Merrill Lynch Investment Bank in London - hardly a militant front for a radical socialist movement. There is no hammer-and-sickle above Merrill Lynch’s corporate logo in their Boardroom.

To re-cap; Mr Luxon owns seven properties. At 2021 they were valued at $27 million - a figure that has most likely increased since then.

By contrast, compare Mr Luxon’s tax-free gain with that of workers who pay tax on every cent they earn. Even after paying tax on their earnings, they pay tax (GST) on every dollar they spend. If that’s not enough, homeowners (and renters, via their rent), pay rates (a local body tax) plus GST on those rates - a tax on a tax.

Workers like “Bob”* - who used to work full time as a Community Worker. “Bob” earned around $26.10/hr and recently began to receive superannuation. “Bob” has continued working as he likes his job, likes his clients, and says he doesn’t feel his age. If the government wants to throw money at him, he says, he won’t say no.

Then he got his first tax bill $1,199.48.

.

.

He was stung not just with paying tax - but secondary tax. It left a nasty taste in his mouth, especially as he is continually reminded that people like our Prime Minister not only pay no tax on their capital gains - but also feel entitled for more of our tax-dollars:

.

.

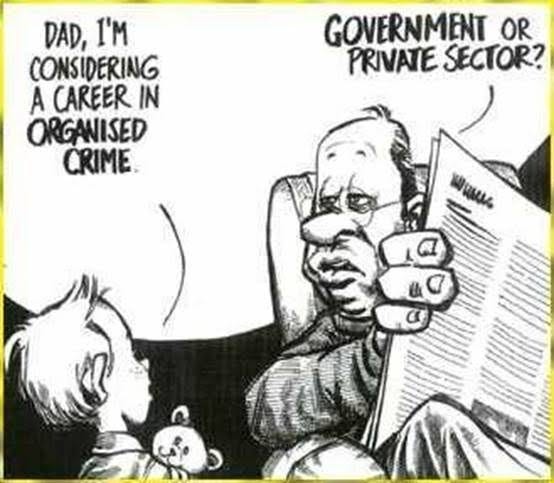

And that’s the crux of the matter. Entitlement. The National Party and its ally, ACT, are bloated with an obscene sense of entitlement.

Not content with tax-free capital gains - National has squandered $2.9 billion by returning tax depreciation for landlords:

.

.

In response to an avalanche of strident criticism to giving taxbreaks for landlords, Mr Luxon was openly trolling the whole country when he shamelessly maintained:

“I'd say to you, I don't think it has been a backlash. I think if you're a renter, you're very grateful for the fact that actually costs that have been passed on to landlords are not being passed on to you.”

Finance Minister, Nicola Willis, had the cheek to assert that tax depreciation for landlords would “make our tax system fairer”.

At a time when our Health system is critically under-staffed; over-worked; and under-funded; schools are denied new classrooms; and Scrooge-like $5 prescription charges have been brought back - landlords are gifted with nearly $3 billion.

Just when you wondered what new abomination awaits us each new morning, we see astonishing, gobsmacking headlines like this:

.

.

Meanwhile, last year, ‘Bob’ reduced his work hours from 40 to 25 per week, in an effort to manage his tax bill. Too late; this year he has received a demand for $2,403.85 to be paid by next February.

Then “Bob” sees Mr Luxon’s tax free $700,000 and he is understandably not a happy-chappy. “Work hard and get ahead” is not a phrase that sits well with “Bob”.

But there is an aspect to our politicians awarding landlords their generous tax depreciation that has not been adequately scrutinised and has been totally over-looked by our news media.

Conflict of interest.

Many of our politicians are also landlords (or at least own more than one house/property).

Which means that many of our elected Parliamentary representatives have voted in favour of tax breaks for themselves:

NATIONAL

Carl Bates (National, Whanganui)

* Rental property (in trust) – Whanganui

* Rental apartments (x2; in trust) – Wellington

Hon Andrew Bayly (National, Port Waikato)

* Farm (in trust) – Waikato

* Share of house (in trust) – Coromandel

* Apartment (in trust) – Wellington

* Share of apartment (in trust) – Queenstown

* Share of residential property (through Paparimu Land Limited) – Onehunga,

Auckland

* Commercial property (in trust) – Pukekohe

Rt Hon Gerry Brownlee (National, List)

* Property – Havelock, Marlborough

* Residential property (x2) – Ilam, Christchurch

* Residential property – Fendalton, Christchurch

* Residential property – Wellington

Dr Carlos Cheung (National, Mt Roskill)

* Rental properties (x5; jointly owned) – Auckland

Hon Judith Collins (National, Papakura)

* Commercial and residential property (owned by superannuation scheme) –

Wellington

* Residential property (owned by superannuation scheme) – Nelson

Tim Costley (National, Ōtaki)

* Rental properties (x2) – Palmerston North

* Flat – Wellington

Hon Matt Doocey (National, Waimakariri)

* Residential property (owned by trust) – Merivale, Christchurch

* Rental property (owned by trust) – Burnside, Christchurch

* Avonhead Shopping Centre (part owned by trust) – Avonhead, Christchurch

Greg Fleming (National, Maungakiekie)

* Ladies Mile Syndicate – property investment syndicate

Paulo Garcia (National, New Lynn)

* Apartment (unit title) – Wellington Central

Hon Paul Goldsmith (National, List)

* Apartment – Wellington

* House (half share) – Waitakere Ranges

Hon Nicola Grigg (National, Selwyn)

* Rental property – Rolleston

Dana Kirkpatrick (National, East Coast)

* Family holiday home – Lake Tarawera

* Family apartment – Gisborne

(Family home in Gisborne excluded.)

Barbara Kuriger (National, Taranaki - King Country)

* Family home (owned by LS&BJ Kuriger Trusts Partnership) – New Plymouth

* Dairy farm (owned by Shortland Farm Limited Partnership) – Ōpunake

* Dairy farm (owned by Shortland Farm No 2 Limited Partnership) – Ōpunake

* Dairy farm grazing unit (joint leasehold interest) – Ōpunake

* Apartment (owned by LS&BJ Kuriger Trusts Partnership) – Wellington

(Family home in Te Awamutu excluded.)

Hon Melissa Lee (National, List)

* Rental property (owned by superannuation scheme) – Wellington

Nancy Lu (National, List)

* Rental properties (x2) – Auckland

Rt Hon Christopher Luxon (National, Botany)

* Residential properties (x2) – Auckland

* Residential property – Wellington

* Investment properties (x4) – Auckland

David MacLeod (National, New Plymouth)

* Apartment – Wellington

* Bach – Kinloch

Hon Todd McClay (National, Rotorua)

* Private home – Pukehina

(Property in Belgium excluded. Family home in Rotorua excluded.)

Hon Mark Mitchell (National, Whangaparāoa)

* Apartment – Thorndon, Wellington

* Rental property (commercial) – Pukekohe, Auckland

* Rental property (residential) – Ōrewa, Auckland

* Rental property (residential) – Māngere Bridge, Auckland

* Family holiday home – Kūaotunu, Coromandel

Katie Nimon (National, Napier)

* Rental property – Havelock North, Hastings

* Rental property (jointly owned) – Hoon Hay, Christchurch

Hon Tama Potaka (National, Hamilton West)

* Rental property (x2; jointly owned) – Auckland

* Family farm and houses (in Tatau Tatau Trust) – Rangitīkei

Maureen Pugh (National, West Coast - Tasman)

* Farm – Turiwhate

* Timeshare – Toormina, New South Wales, Australia

Suze Redmayne (National, Rangitīkei)

* Apartment (jointly owned with trust) – Auckland

* Farm (owned by trust) – Turakina

Hon Dr Shane Reti (National, Whangārei)

* Commercial building (in Shane Reti Blind Trust) – Whangārei

* Rental property (in Shane Reti Blind Trust) – Kohimarama

(Family home in Whangārei excluded)

Hon Penny Simmonds (National, Invercargill)

* Family cribs (x3; owned by family trust) – Riverton, Southland

* Rental property (owned by family trust) – Invercargill

(Family home and farm in Mabel Bush and Ryal Bush, Southland excluded)

Hon Scott Simpson (National, Coromandel)

* Land (owned by New Chums Trust) – Whangapoua, Coromandel

* Family home – Thames

* Rental property – Remuera, Auckland

(Family home in Kūaotunu, Coromandel excluded)

Stuart Smith (National, Kaikōura)

* Apartment (owned by Tayler-Smith Family Trust) – Thorndon, Wellington

* Timeshare week (owned by Tayler-Smith Family Trust) – Queenstown Mews

* Rental property (owned by Tayler-Smith Family Trust) – Redwood, Blenheim

* Apartment (half-share owned by Tayler-Smith Family Trust) – Frankton,

Queenstown

(Family home in Blenheim excluded)

Hon Erica Stanford (National, East Coast Bays)

* Residential property, holiday home (owned by family trust) – Whangamatā

Hon Louise Upston (National, Taupō)

* Apartment (jointly owned) – Wellington

Tim van de Molen (National, Waikato)

* Horticultural property (owned by Caritim Limited) – Tamahere, Waikato

* Residential houses (x2; owned by van de Molen Family Trust) – Tamahere,

Waikato

Hon Simon Watts (National, North Shore)

* Commercial property (owned by trust) – Cambridge

* Holiday home (owned by trust) – Waihi Beach

Catherine Wedd (National, Tukituki)

* Apartment – Wellington

Dr Vanessa Weenink (National, Banks Peninsula)

* Apartment – Wellington Central

* Rental property – Merivale, Christchurch

Hon Nicola Willis (National, List)

* House (owned by Appledore Trust) – Kelburn, Wellington

* House (owned by Appledore Trust) – Riversdale, Wairarapa

* House (owned by Appledore Trust) – Wānaka

ACT

Simon Court (ACT, List)

* Family home (jointly owned) – Thorndon, Wellington

* Family home (P & S Court Trust) – Glenholme, Rotorua

* Family home (P & S Court Trust) – Whangaparāoa, Auckland

(Family home in Waitakere excluded)

Cameron Luxton (ACT, List)

* Rental properties (x2; as beneficiary of trust) – Tauranga

* Commercial properties (x2; as beneficiary of trust) – Tauranga

Dr Parmjeet Parmar (ACT, List)

* Residential rental property – Remuera, Auckland

* Residential rental property – Half Moon Bay, Auckland

* Commercial property – Mount Wellington, Auckland

* Commercial and residential property (owned by RP and M Parmar Partnership) –

Flat Bush, Auckland

Hon David Seymour (ACT, Epsom)

* Residential home (as discretionary beneficiary of trust) – Whangārei

* Holiday home (as discretionary beneficiary of trust) – Northland

* Section (as discretionary beneficiary of trust) – Whangārei

(Family home in Auckland excluded)

Todd Stephenson (ACT, List)

* Apartment (x2; jointly owned) – Wellington

* Apartment (jointly owned) – Sydney, Australia

* Apartment (jointly owned) – Geelong, Australia

* Apartment (held in a trust) – Wellington

* Rental property (held in a trust) – Te Anau

NZ FIRST

Hon Casey Costello (NZ First, List)

* Family holiday home – Bland Bay, Northland

Hon Shane Jones (NZ First, List)

* House – Maimaru

* House – Hihi, Tai Tokerau

* Houses (x2) – Mill Bay, Tai Tokerau

Rt Hon Winston Peters (NZ First, List)

* House – St Marys Bay, Auckland

* House – Whananaki South, Northland

* Land – Whananaki South, Northland

(It is unclear which, if any, of these properties is Mr Peters' primary residence.)

Where it is openly stated that a property is the primary family/personal home, I have excluded that asset in the interest of fairness. Some properties in Trusts may be the family home, but the description within the List of Pecuniary Interests does not make it clear.

I have deliberately excluded multiple properties owned by Opposition Parties’ MPs. They did not vote for tax depreciation for landlords.

All up, forty-two MPs from National, ACT, and NZ First own more than just their primary residence. The collective worth of these assets is likely in the hundreds of millions - if not over a billion - dollars.

All of it, tax free if/when they are eventually sold.

Every single one of those MPs voted to reduce the “brightline” test from ten years to two, and reintroduced depreciation for interest on any mortgage interest owing. They also staunchly oppose a Capital Gains Tax which they would have to pay on the sale of their property investments.

For landlord MPs to vote on legislation that benefits landlords to the tune of $2.9 BILLION dollars has to be one of the most colossal conflicts of interest ever in our Parliamentary history.

Yet, our media has utterly failed to pick up on this.

Contrast that to the crucifixion of former Transport Minister, Michael Wood, who failed to declare and divest himself of just over 1,500 shares in Aucland Airport.

.

.

The value of these shares? Approximately $13,000.

Compare Mr Wood’s $13,000 “conflict of interest” with National/ACT/NZ First MPs property investments voting on tax laws relating to… property investments. Hundreds of millions - perhaps billions - of dollars worth of property investments.

All. Tax. Free.

The comment from the National Party’s Paul Goldsmith, (then in Opposition) was particularly and spectacularly galling:

“Mr Wood has confirmed he owns $13,000 worth of Auckland International Airport shares, which presents a clear conflict of interest for a Minister of Transport responsible for Auckland’s transport network and as Minister for Auckland.”

Meanwhile, ordinary folk like “Bob” pay tax after tax after tax on their earnings and spending. Plus a multitude of user-pay charges and levies such as prescription fees and fuel excise tax (which also attract GST - taxed twice!).

But property speculators - sorry, “investors” - pay zero tax on their capital gains.

We understand the conflict of interest. It is now time for Labour, Greens, and Te Pāti Māori to resolve this inequity once and for all.

Otherwise, what good are you?

Just ask “Bob” and other New Zealanders like him.

The Cabinet Manual

There is a document called The Cabinet Manual. The Manual lays out the standards “to protect the integrity of the decision-making process of executive government and to maintain public trust in the Executive, Ministers and Parliamentary Under-Secretaries must conduct themselves in a manner appropriate to their office”.

Amongst various requirements relating to conflict of interest is this:

“2.60 Ministers are responsible for ensuring that no conflict exists or appears to exist between their personal interests and their public duty. Ministers must conduct themselves at all times in the knowledge that their role is a public one; appearances and propriety can be as important as actual conflicts of interest. Ministers should avoid situations in which they or those close to them gain remuneration or other advantage from information acquired only by reason of their office.”

And:

2.63 “A conflict of interest may be pecuniary (that is, arising from the Minister's direct financial interests) or non-pecuniary (concerning, for example, a member of the Minister's family). A conflict of interest may be direct or indirect. Ministers must consider all types of interest when assessing whether any of their personal interests may conflict with, or be perceived to conflict with, their ministerial responsibilities.

Pecuniary interests

2.64 Pecuniary interests are financial interests such as assets, debts, and gifts. A pecuniary conflict of interest may arise if a Minister could reasonably be perceived as standing to gain or lose financially from decisions or acts for which they are responsible, or from information to which they have access…”

Similar requirements and expectations exist for ordinary Members of Parliament.

Ministers and MPs voting on taxation matters (or rejecting new taxes that will impact on their personal investments) relating to investment properties, whilst holding same investment properties, has to be the greatest conflict of interest that this country has seen in a long time.

The response of mainstream media? *nudge, nudge, wink, wink”. (Monty Python reference.)

Is that good enough? I think not.

.

Postscript

Mr Luxon’s comments on property speculation and Capital Gains Tax are revealing. From 16:17 onwards:

.

.

Jack Tame asks Mr Luxon: “How do I know you are not just opposing a capital gains tax because that’ll mean you pay more tax?”

Mr Luxon’s response will make you cough your tea/coffee/beer over your screen. And he said it without a shred of self-awareness..

Poem for the Day

Hi, meet Bob

Bob has a job

These are the facts

Bob pays tax

Luxury Luxon ‘lucks in’

NO TAX

— Dee

* (Name changed for privacy)

.

References

Moneyhub: Capital Gains Tax in New Zealand

Stuff media: Prime minister selling Onehunga rental property

The Post: Christopher Luxon puts investment property on the market

IRD: History of buying and selling property

Stuff media: New survey shows widespread support for taxes on capital gains and windfall profits

Moneyhub: About MoneyHub & Christopher Walsh

NZ Herald: Christopher Luxon's houses earned him 15 times what he will get as National Party leader

Wairarapa Times Age: Chris Luxon - ‘Entitlement’ or just entitled?

NZ Herald: Cost of landlord tax break increased by $800m to $2.9b

RNZ: PM Christopher Luxon argues renters will be 'grateful' for interest deductibility change

Beehive: Passage of major tax bill welcomed - Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill

Stuff media: Far North doctor shortage now 'acute', clinical manager warns

Stuff media: 'People could die waiting' - Overworked nurses on ED wait times

RNZ: Heath funding fails to keep up with inflation or demand - doctors' union

Stuff media: Government is scrapping classroom upgrades to pay for tax cuts, Labour claims

RNZ: Prescription fees return - 'We're going to see higher rates of hospital admissions'

NZ Herald: Hutt Hospital doctors told to make beds, clean sinks

Stuff media: Michael Wood sells controversial Auckland Airport shares

TVNZ: Inquiry launched into Michael Wood's airport shares

The Post: Carelessness or something else? Michael Wood fights for political career over airport shares

The Spinoff: What to do when your child (Michael Wood) just won’t listen

RNZ: Michael Wood's reminders to divest his shares - A timeline

Newshub: Timeline - How the Michael Wood shares debacle played out

RNZ: Transport Minister Michael Wood stood down after airport shares controversy

Newshub: Labour's Michael Wood opens up about airport shares saga

National Party: Wood’s airport shares raise major trust issues

Cabindet Manual: Conduct, public duty, and personal interests

Youtube: Chris Luxon - Genetic engineering, farming emissions, and capital gains taxes | Q+A 2023

Additional

TVNZ: Q+A - Luxon challenged over his 7 houses: ‘Who owns more than you?'

NZ Herald: Christopher Luxon's houses earned him 15 times what he will get as National Party leader

One Roof: PM selling ‘$1m’ investment property in Onehunga

Department of the Prime Minister and Cabinet: Proactive release of information about management of ministerial conflicts of interest

Department of the Prime Minister and Cabinet: Conduct, public duty, and personal interests

Parliament: Members' financial interests (explanatory page)

Parliament: Initial returns – 2024

Parliament: Amendments – 2023/24

Other Blogs

Emily Writes Weekly: It’s an entitlement and I’m entitled to it

Emily Writes Weekly: The Crushing True Cost of Tax Breaks For the Rich

Gordon Campbell on Luxon’s landlord myths, and the needless nightmare of high interest rates

Gordon Campbell on the US opposition to mortgage interest deductibility for landlords

Gordon Campbell on the attack of the tax cut zombies, and a music playlist

Nick's Kōrero: Empty Promises.

Nick's Kōrero: As Low As You Go

No Right Turn: Tax the rich!

The Standard: Multimillionaire landlords are the real squeezed middle according to National

The Standard: NZ Initiative – tax cuts are silly at present. I have to agree.

Previous related blogposts

A Capital Gains Tax? (14 July 2011)

Tax cuts & school children (2 February 2012)

National’s 2005 tax cut plans still credible – Key (6 June 2012)

The Mendacities of Mr Key #3: tax cuts (2 March 2014)

National spins BS to undermine Labour’s Capital Gains Tax (31 May 2014)

The consequences of tax-cuts – worker exploitation? (31 October 2015)

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble! (2 December 2016)

Cutting taxes toward more user-pays – the Great Kiwi Con (31 January 2017)

Standard & Poor’s just sabotaged Simon Bridges’ tax bribe announcement (6 February 2019)

.

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

Great writing Frank, the self interest is well beyond an elephant in the room - it is a complete circus…

As always Frank your posts are so informative and challenging and are really what the Lame Stream Media should be asking. "put a hat on it and call it a weasel" but it is definitely a huge conflict of interest.